Cash Charitable Contributions 2025. See how donors apply different giving strategies to achieve their philanthropic goals. Here’s what you need to know.

Learn about tax deductions on donations, discover what qualifies as a charitable donation, how tax deductions work, and the documentation you need. In 2025, the qcd limit is $105k.

When you donate money to a qualifying public charity, you can deduct up to 60% of your income, alleviating your tax burden.

3 Reasons You Should Make Charitable Contributions Now Cantley Dietrich, Most laws around charitable giving may change as provisions in the tax cuts and jobs act sunset by the end of 2025, williams said. This article highlights the key charitable figures for 2025.

20++ Non Cash Charitable Contributions Worksheet Worksheets Decoomo, In 2025, the irs temporarily allowed taxpayers to deduct up to 100% of their. The 2025 and 2025 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash donations for qualified.

Anne Sheets Non Cash Charitable Contributions / Donations Worksheet Excel, Plus, discover how you may be able to. Explore the tax implications of charitable contributions, know about donating to nonprofits.

7 printable receipts templates sampletemplatess sampletemplatess pin, If you are married and file a joint tax return, both you and. Understand 2025 charitable contribution limits.

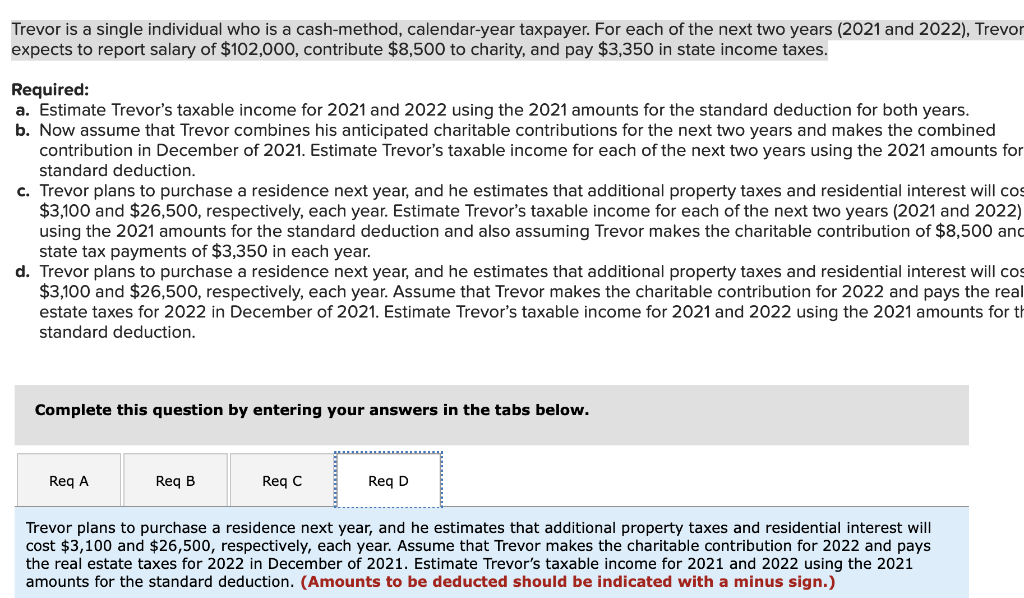

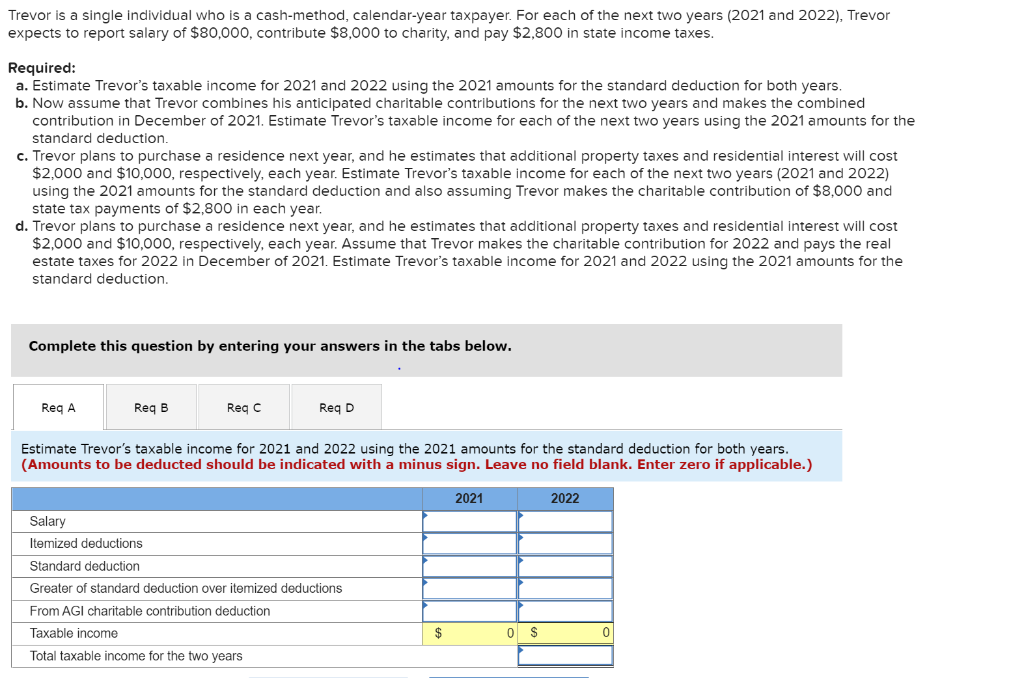

Solved Trevor is a single individual who is a cashmethod,, The day the check was mailed,. Plus, discover how you may be able to.

20++ Non Cash Charitable Contributions Worksheet Worksheets Decoomo, Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. For the 2025 tax year, you can generally deduct up to 60% of your adjusted gross income (agi) in monetary gifts.

Solved Trevor is a single individual who is a cashmethod,, Complete form 8283 (section b), as provided in. The importance of appraisals :

Charitable Donation Deduction A Stepbystep Guide finansdirekt24.se, Learn about tax deductions on donations, discover what qualifies as a charitable donation, how tax deductions work, and the documentation you need. Bring your family together around shared values and goals for generosity through a donor advised fund.

NonCash Charitable Contributions AZ Money Guy, If you are married and file a joint tax return, both you and. These individuals, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions made to qualifying charities during 2025.

Here's how to get this year's special charitable tax deduction, The importance of appraisals : The annual limit applies to the sum of qcds made to one or more charities in a calendar year.

Bring your family together around shared values and goals for generosity through a donor advised fund.